OPINION: Luxury In Pandemic

Share

The outbreak of Coronavirus pandemic has left the luxury industry globally gasping for breath. Despite the optimism that greeted the year 2020, the disease has forced the industry to recoil and put a stop to some remarkable growth projected for the year 2020 by analysts.

The organisers of many global events planned for the year began to announce cancellation from the end of the first quarter. Some organisers who were still optimistic did not cancel. However, by the start of the second quarter, they realized they had no choice but to cancel their shows.

First, the annual world-acclaimed jewellery and watch show, Baselworld, was postponed to January 2020. However, the January date was not to be as the spread of the virus peaked in the first quarter of 2020 globally. Michel Loris-Melikoff, managing director of Baselworld said in a statement that the postponement has become inevitable for health safety reasons following the ban of large-scale public and private events.

Many fashion houses also cancelled previously scheduled fashion shows. Giorgio Armani postponed its April cruise show to November. Versace and Gucci each cancelled their US shows planned for May, while Prada has cancelled its May resort show, which was set to take place in Japan. In addition to fashion shows, many fashion weeks were cancelled, including those in Shanghai, Melbourne, Beijing, Seoul, and Tokyo.

Luxury retailers especially reported mass store closure and millions in revenue shortfalls as a result of the disruption. Almost $54 billion in market value was wiped out for retailers in the MSCI Europe Textiles, Apparel & Luxury Goods Index from when the market closed on January 17 until January 31.

From January 17 to March 11, the MSCI Europe Textiles, Apparel & Luxury Goods fell 23%, with $152 billion in market value erased. Capri Holdings, which owns brands such as Versace, Jimmy Choo, and Michael Kors, said on February 5 that it expected “the situation in China” to cut full-year revenue by about $100 million. At the time, Capri had closed 150 of its stores in mainland China, with the remaining 75 operating with reduced hours.

However, by the start of the third quarter, the retail situation in China has improved. More than 80 per cent of shopping malls and supermarkets have reopened in Beijing, Shanghai, and Guangzhou. Nevertheless, the new concern for luxury was Italy. International retailers depend on Italy for the manufacturing of leather goods, textiles, and accessories. The headquarters of Prada, Gucci, and Armani are all located in Milan. China is an important market for luxury as Chinese customers accounted for about one-third of all luxury-goods purchases in 2018 and led the positive growth trend worldwide, according to a report by the consulting firm Bain & Co.

As reported by Business of Fashion, Capri Holdings fell nearly 24 per cent, while Phillips-Van Heusen, which owns Calvin Klein and Tommy Hilfiger, was down 22 per cent.

WWD also reports that in Europe, Salvatore Ferragamo fell 15.8 per cent, Kering fell 12.3 per cent, Moncler was down 11.4 per cent, Burberry Group fell 9.7 per cent LVMH fell 8.7 per cent and Herms International dropped 5.8 per cent. WWD reported on Friday that LVMH CEO Bernard Arnault had a total of $7.7 billion over the previous day.

Analysts are not exactly sure what the full impact of the pandemic on the luxury markets will be since the year has not ended. Business Insider reports that multiple consulting firms, including Boston Consulting Group and Bernstein, predicted in February that the luxury sector could lose 30 to 40 billion (up to $45 billion) in sales this year.

Burberry said the impact to its bottom line would be worse than that caused by the Hong Kong protests, which cut sales in half in its last fiscal quarter. Kering CEO Francois-Henri Pinault said on an earnings call on February 12 that it was “impossible” to determine what the impact will be or “how fast it will recover.”

Salvatore Ferragamo said it was unable to predict what impact COVID-19 will have on its results, as it reported a 4 per cent drop in its 2019 core profit.

LVMH chief Bernard Arnault and family lost $7.7 billion leaving them with a fortune of $82.5 billion, according to Forbes’ Real-Time Billionaires List.

Besides, sales have been low for luxury retailers forcing them to cut staff strength.

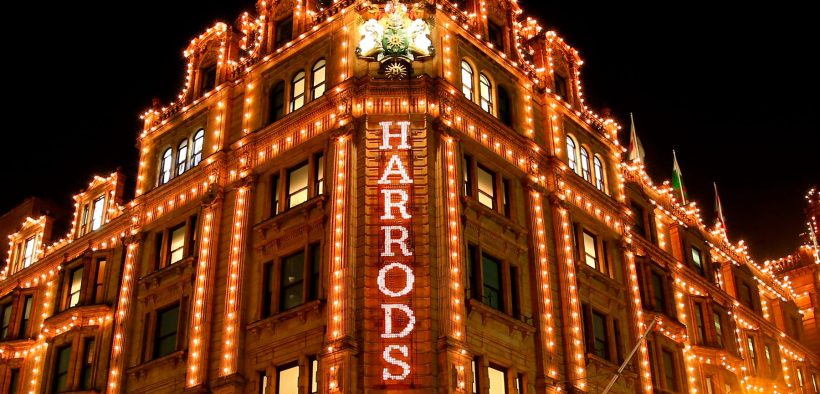

Selfridges announced 450 job cut after its rival Harrods cut 700 jobs earlier this in July. The cuts have been blamed on physical distancing requirements and a lack of tourists’ visit to the United Kingdom. Selfridges online sales doubled during the lockdown and it plans to step up investment in online retail.

The African market is not spared of the negative impact of the pandemic, especially for luxury retail. There has been a drastic cut in consumers’ spending power while producers of African luxury had to cut down on production and manpower. Since the year has not ended, the total loss to the contagion has not been fully computed.

However, retailers are navigating through this challenge digitally. Although in time past, the luxury sector never really embraced the internet. The luxury industry has been cautious in its relationship with the world wide web since it was launched. One could say the industry was conservative in its approach to the use of the internet. Besides, the industry was fearful it will dilute its brand essence. This was a form of culture shock for the luxury industry that typically thinks long term and rarely act under pressure. Luxury brands are more concerned about the sustainability of their brand reputation than anything else which has been the staying power behind their pricing.

NOTE: This article was first published in Business Day in the column ‘Luxe Thoughts With Funke Osae-Brown